Why Recurring Payments Matter for Small Businesses

For small businesses—whether you run a subscription box service, an online course platform, or a digital media company—the need for a recurring payments setup for small business is more important than ever. Manually managing invoices, chasing late payments, and handling customer subscriptions can quickly drain time and resources. The solution? Automate recurring billing to simplify your operations, improve cash flow, and offer a frictionless customer experience. This guide will show you exactly how to implement recurring payments, the tools you need, and how small businesses can leverage this system to thrive. How to set up recurring payments for subscription businesses? Failed payments cost subscription businesses 15-20% monthly revenue (Stripe 2024). An effective recurring payments setup requires:

- Payment gateway integration

- Automated billing cycles

- Smart dunning workflows

- Tax-compliant invoicing. GetUpfront reduces payment failures by 85% while cutting setup time to 48 hours.

What is Recurring Payments Setup for Business?

A recurring payments setup for small business allows you to automatically collect payments from customers on a set schedule—weekly, monthly, or annually—without needing to send invoices manually or wait for manual payments.

Such systems are perfect for:

- Subscription services

- Membership-based businesses

- Service providers offering retainers or ongoing packages

An automated billing solution manages:

- Invoice generation

- Payment collection

- Tax calculation

- Receipts and notifications

Why Businesses Must Automate Recurring Billing

1. Predictable and Steady Revenue

With a proper recurring payments setup for small business, revenue becomes consistent and forecastable. Whether you’re running a yoga studio or a software platform, you can confidently plan marketing, hiring, and growth.

Eliminates cash flow uncertainty.

2. Time and Resource Efficiency

To automate recurring billing means fewer manual tasks, lower chances of human error, and reduced time spent chasing invoices. This allows your team to focus on value-generating activities like sales and customer retention.

Saves admin costs and boosts productivity.

3. Simplified Invoicing for Service Businesses

For consultancies, agencies, or freelancers offering monthly services, recurring invoicing for service businesses is a must. It ensures clients are billed the right amount, on time, without manual reminders.

Keeps both you and your clients on schedule—no awkward payment follow-ups.

4. Better Subscription Business Payment Solutions

If you’re running a subscription box, software service, or digital content platform, you need reliable subscription business payment solutions that can manage customer sign-ups, upgrades, and renewals without friction.

Offers customers self-service options for plan changes and payment updates.

5. Scalability with Affordable Tools

Contrary to belief, great billing software doesn’t have to be expensive. There are many affordable subscription billing software options that offer robust automation features for small businesses, helping you scale without breaking the bank.

Grow without heavy tech investment or developer resources.

How to Set Up Recurring Payments for Business: Step-by-Step

Phase 1: Foundation Setup (Day 1)

| Task | Key Actions |

|---|---|

| Gateway Selection | Choose PCI-compliant provider (Stripe, PayPal, Adyen) |

| Tax Configuration | Set automated tax rules (VAT/GST) |

| Customer Data Import | Migrate subscribers with billing history |

| Compliance Check | Ensure GDPR/CCPA readiness |

Phase 2: System Configuration (1-2 Days)

A. Billing Engine Setup (via GetUpfront):

1. **Subscription Plans:** - Tiered pricing (Basic: $99/mo, Premium: $299/mo) - Proration rules for mid-cycle changes 2. **Tax Automation:** - Auto-calculate VAT/GST based on customer location - Digital service tax handling 3. **Invoice Branding:** - Custom templates with company logo - Sequential numbering

B. Payment Gateway Integration:

- Smart Routing: Prioritize high-success-rate payment methods

- Retry Logic: 3 automated attempts over 7 days

- Multi-Currency: Accept USD, EUR, GBP with auto-conversion

Phase 3: Testing & Launch (Day 3)

- Test Scenarios: » Successful payments » Failed payment recovery » Plan upgrades/downgrades

- Go-Live Strategy: » Start with 10% of customers » Monitor via real-time dashboard

Launch Recurring Billing in 48 Hours

GetUpfront handles payment gateways, tax compliance & failed payment recovery. Free setup assistance included.

Start Free Trial →Key Benefits of Automated Recurring Billing

| Benefit | Manual Process | Automated Solution |

|---|---|---|

| Payment Success Rate | 75-80% | 92-95% (Smart retries) |

| Setup Time | 4-6 weeks | 48 Hours |

| Customer Churn | 6-8% monthly | 2-3% |

| Operational Cost | $800+/month | From $49/month |

| Tax Error Rate | 12-15% | <1% |

Case Study: SaaS company reduced churn by 32% and grew ARR 45% in 6 months with GetUpfront.

Overcoming Top 3 Recurring Billing Challenges

Challenge 1: Payment Failures

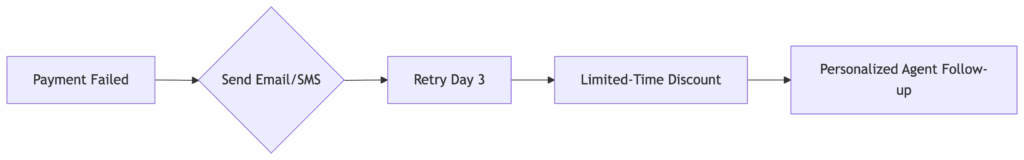

- Solution: AI-powered dunning workflows:

Recovers 75% of failed payments

Challenge 2: Subscription Churn

- Retention Tactics: Offer annual billing (15-20% discount) Grace periods for payment failures Win-back campaigns for cancellations

Challenge 3: Global Tax Compliance

- GetUpfront Fix:

- Auto-tax calculations for 130+ countries

- Digital service tax handling

- Localized invoice templates

Choosing Your Recurring Payments Software

Essential Features:

- Flexible Billing: Usage-based/tiered pricing

- Smart Dunning: Automated payment recovery

- Tax Automation: Real-time calculations

- Affordable Pricing: Transparent per-transaction fees

- Integrations: QuickBooks/Xero/CRM sync

GetUpfront vs. Competitors:

| Feature | Basic Tools | GetUpfront |

|---|---|---|

| Payment Success Rate | 80-85% | 92-95% |

| Implementation Time | 2-4 weeks | 48 Hours |

| Churn Reduction | Limited | AI Retention Engine |

| Pricing | $299+/month | From $49/month |

Recurring Payments FAQs

How much does recurring payments setup cost? GetUpfront starts at $49/month including:

- Unlimited subscribers

- 3 payment gateways

- Automated tax compliance No setup fees. First 100 invoices free.

Can we bill annually but charge monthly installments? Yes. – Annual contract: $1,200 – Monthly charges: $100 – Auto-prorated upgrades How to handle failed payments internationally? Our smart recovery system:

- Retries during local business hours

- Switches payment methods (card → bank transfer)

- Offers country-specific alternative payments

Can we automate billing for service businesses? Absolutely. Set up:

- Recurring retainers + hourly overages

- Project-based billing with milestones

- Auto-invoicing upon deliverable completion

Transform Subscriptions Into Growth Fuel

Businesses with automated recurring payments: → Reduce churn by 30-40% → Recover 75% of failed payments → Save 15+ hours/month on billing tasks → Scale globally without operational bottlenecks Stop losing revenue to billing chaos. Automate Your Subscriptions Today.

Next to Know

→ Unified data power: AR-CRM Integration→ End-to-end efficiency: Invoice to Cash Workflow→ Payment ecosystem: Embedded Payment Solutions→ System harmony: Enhancing AR Processes