What Are Embedded Payment Solutions?

Embedded payment solutions integrate payment processing directly into business software (like ERP or invoicing platforms), eliminating third-party gateways. Modern platforms like GetUpfront combine embedded payments with automated receivables financing, real-time tracking, and dynamic discounting—creating a seamless cash flow ecosystem for UAE businesses..

The Rise of Embedded Payment Solutions in the UAE Enterprise Market

As UAE and GCC enterprises race towards digital transformation, the demand for embedded finance and payment solutions is surging. From SaaS platforms to retail systems, businesses are embedding payment processing directly into their workflows to streamline transactions, reduce errors, and accelerate receivables.

But what makes embedded payment solutions different from traditional gateways or integrated payments? And how does GetUpfront.io uniquely solve this for UAE businesses?

Let’s break this down.

Problem: The Challenges of Traditional Payment Systems in Enterprise Finance

Despite the rise of digital commerce in Dubai, many CFOs of SaaS companies and service businesses (50+ invoices/month) still suffer from:

-

Manual invoice errors causing delayed payments (up to 30% of cases in GCC markets)

-

Clunky third-party payment portals that reduce customer trust

-

High reconciliation workloads for finance teams

-

Lack of real-time tracking for incoming payments

-

Poor integration between invoicing, reconciliation, and cash flow forecasting

These problems not only disrupt cash flow but also put FTA e-invoicing compliance at risk.

Why Embedded Payments Dominate Enterprise Finance

The GCC’s digital economy is projected to hit $40B by 2026 (McKinsey), with embedded finance driving growth. Here’s why UAE enterprises are adopting these solutions:

- Faster Transactions: Payments process within workflows (no redirects)

- Higher Conversion: 72% lower checkout abandonment (Baymard)

- Automated Reconciliation: AI matches payments to invoices instantly

- Regulatory Compliance: Built-in adherence to UAE VAT and FTA rules

Solution: Embedded Payment Solutions vs. Traditional Methods (Comparison Table)

| Feature | Traditional Payment Gateways | GetUpfront’s Embedded Payment Solutions |

|---|---|---|

| Invoicing Automation | Manual or semi-automated invoicing prone to errors | Automated Invoicing integrated with payment processing |

| Reconciliation | Requires manual effort from finance teams | Automated Reconciliation ensures books match in real time |

| Payment Tracking | Limited or no real-time updates | Real-Time Tracking via Integrated Dashboard |

| User Experience | Redirection to third-party portals | Embedded Payments within your platform |

| Cash Flow Control | Reactive, not predictive | Receivables Financing and Dynamic Invoice Discounting for control |

How GetUpfront.io Uniquely Powers Embedded Payment Solutions in the GCC

1. Embedded Payments for UAE & GCC Enterprises

With GetUpfront’s Embedded Payments, customers pay invoices directly inside your ERP, SaaS, or e-commerce platform—no external portals. This ensures:

-

Faster transactions

-

Reduced payment abandonment

-

Higher customer trust (critical for Dubai’s regulated market)

2. Real-Time Tracking & Integrated Dashboard

GetUpfront’s Integrated Dashboard offers CFOs a bird’s-eye view of receivables, payment status, and projected cash flow—essential for compliance with FTA e-invoicing mandates.

3. Receivables Financing & Dynamic Invoice Discounting

Need faster access to cash? Use Receivables Financing or offer discounts via Dynamic Invoice Discounting to accelerate payments from clients—ideal for scaling SaaS models in Dubai.

4. Automated Invoicing + Reconciliation

Invoices are generated, sent, and matched against payments automatically—eliminating 90% of manual errors common in UAE enterprise finance.

Examples of Embedded Payment Solutions in Action

-

B2B SaaS Platforms: Auto-billing with embedded online payment solutions keeps subscription cash flow steady.

-

E-commerce Marketplaces: Seamless checkout and instant reconciliation via embedded finance tools.

-

Service Providers (Dubai/UAE): One-click embedded online payment solution reduces friction for invoicing high-ticket services.

Emerging Trends in Embedded Payments (UAE & GCC Focus)

-

AI-driven payment scheduling based on client payment behavior

-

Rise of FTA-compliant e-invoicing systems with embedded payment modules

-

Increased adoption of Enterprise Payment Solutions in logistics, construction, and healthcare sectors in Dubai

-

BNPL (Buy Now Pay Later) as an embedded finance option for B2B clients

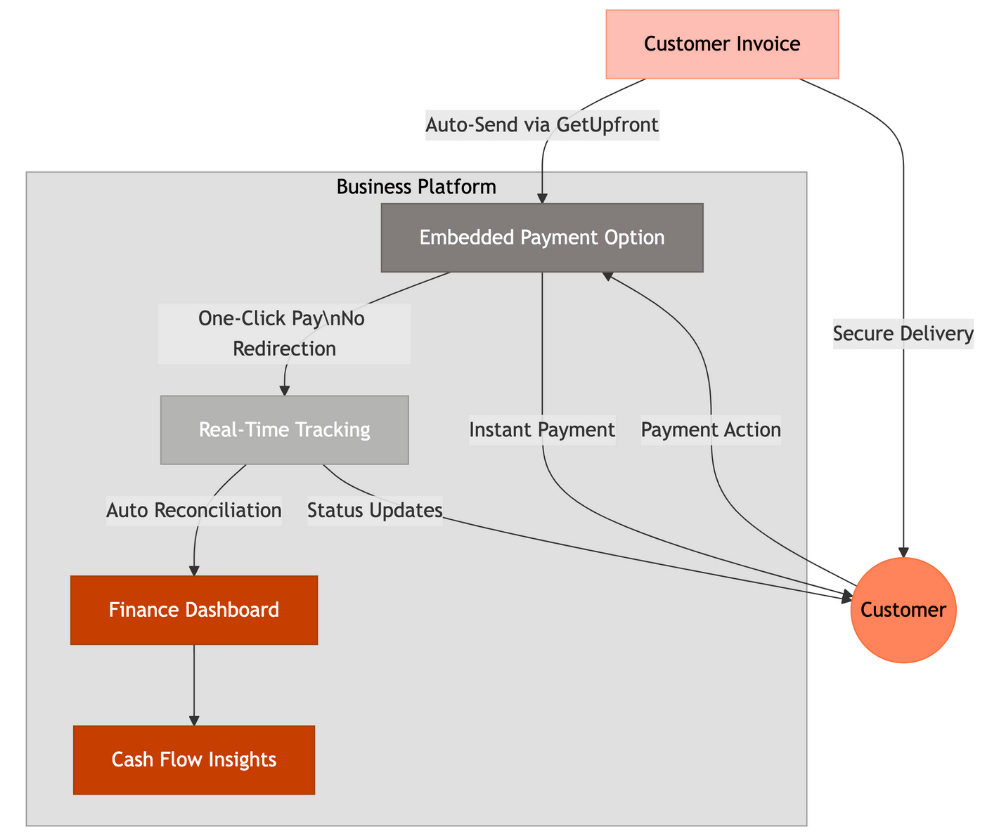

Diagram: How Embedded Payment Solutions Work

FAQs About Embedded Payment Solutions

1. What are embedded payment solutions?

Embedded payment solutions allow businesses to integrate payment processing directly into their platforms—eliminating the need for third-party payment portals. This improves efficiency, reduces errors, and speeds up cash flow cycles.

2. What is the difference between integrated and embedded payments?

While integrated payments connect your platform to a third-party processor, embedded payment solutions keep the entire process within your ecosystem—offering smoother UX, faster processing, and better control.

3. How can UAE businesses benefit from embedded finance?

Embedded finance solutions help UAE enterprises by offering real-time payment tracking, automated reconciliation, and receivables financing—crucial for maintaining liquidity and FTA tax compliance.

4. Are embedded payments secure?

Yes. GetUpfront’s Embedded Payments feature uses enterprise-grade encryption and complies with UAE’s digital invoicing and data protection laws, ensuring every transaction is secure and compliant.

5. What industries in the GCC use embedded online payment solutions?

SaaS companies, logistics, healthcare, real estate, and professional services in Dubai and GCC are fast adopters, leveraging embedded payment solutions to optimize cash flow and client payment experiences.

Conclusion: Ready to Transform Your Payment Processing?

GetUpfront.io is more than an AR automation tool—it’s your gateway to fully embedded, secure, and scalable payment solutions, custom-built for UAE and GCC enterprises.

Confused about e-invoicing compliance?

Upfront simplifies the switch from digital invoicing to fully FTA-compliant e-invoicing — no technical headaches, just automated, secure billing.

Book a Free Demo →Why GetUpfront Leads in UAE Embedded Finance

-

Localized Compliance: Pre-built UAE VAT rules

-

Enterprise-Grade Security: ISO 27001 certified

-

Proven ROI: Clients like [UAE Logistics Co.] reduced DSO by 35 days

Ready to modernize your payment workflows? Book a GetUpfront demo today →