How Automated Invoicing Reduces Errors for SMEs in the UAE

Automated invoicing reduces human errors, speeds up payments, and ensures tax compliance for SMEs, where e-invoicing regulations are strict. Platforms like Upfront automate billing workflows, minimizing mistakes and improving cash flow.

Common Invoicing Errors

For small and medium-sized businesses (SMEs), manual invoicing remains a risky and error-prone process. Common invoicing mistakes can slow down cash flow, damage customer relationships, and even lead to tax penalties—where VAT compliance is strictly enforced.

The most frequent manual invoicing errors include:

- Incorrect invoice amounts due to manual calculations

- Duplicate invoices sent to customers

- Missing mandatory fields such as VAT number, PO references, or QR codes (as required by the FTA)

- Late invoice issuance, causing delayed payments

- Misapplied VAT rates or tax rules

- Lost or unarchived invoices, risking audit failures

Each of these errors increases DSO (Days Sales Outstanding) and reduces trust between SMEs and their clients.

How Automated Invoicing Software Reduces Errors for SMEs

Investing in automated invoicing software like Upfront can help SMEs reduce invoicing errors, prevent invoice mistakes, and improve processing accuracy. Here’s how automation transforms the process:

1. Eliminates Manual Data Entry Errors

- Auto-fills customer names, VAT numbers, and line items.

- Syncs with accounting systems such as QuickBooks, Zoho Books, and Xero.

- Reduces typos and calculation mistakes by over 90%.

2. Prevents Duplicate and Missing Invoices

- Built-in checks avoid sending the same invoice twice.

- Ensures every invoice contains mandatory fields (e.g., invoice number, VAT QR code) .

3. Improves Invoice Accuracy and Consistency

- Automatically calculates totals, VAT, and discounts.

- Standardizes invoice templates to maintain brand and compliance standards.

- Supports recurring invoices and bulk billing for high-volume clients.

4. Speeds Up Payment Collections

- Sends automated reminders for overdue invoices via email or SMS.

- Integrates with payment gateways for instant settlement.

- Results in 30-50% faster payments compared to manual invoicing.

5. Guarantees VAT and Compliance

- Generates FTA-compliant electronic invoices with QR codes and audit-ready records.

- Updates automatically as tax laws and VAT rules change.

Tired of Invoice Errors Costing You Money?

Upfront automates your invoicing, reduces mistakes, and keeps your UAE business compliant—effortlessly.

Book a Free Demo →Manual vs. Automated Invoicing: What’s Better for SMEs?

For small businesses , choosing between manual vs automated invoicing is no longer just about preference—it’s about survival in a fast, compliance-driven market. Let’s compare both approaches to understand why more SMEs are shifting to automated solutions like Upfront.

| Feature | Manual Invoicing (Risky & Slow) | Automated Invoicing (Upfront Advantage) |

|---|---|---|

| Error Rate | High (prone to manual mistakes and typos) | Near-zero — automated invoicing software reduces errors using AI |

| Speed of Processing | Slow — takes hours per invoice | Instant — invoices generated in seconds with automated processing accuracy |

| VAT Compliance (UAE FTA regulations) | Risky — updates must be applied manually | Auto-updated — always FTA-compliant, including QR codes & Arabic fields |

| Duplicate or Missing Invoice Risk | Very likely | Eliminated — built-in validation checks to reduce invoicing errors for small businesses |

| Payment Collection Speed (Cash Flow) | Delayed — 30+ days DSO (average) | Faster — 50% quicker payments thanks to reminders & payment links |

| Admin Workload | High — repetitive data entry & chasing payments | Low — automation saves 18+ hours/month on AR tasks |

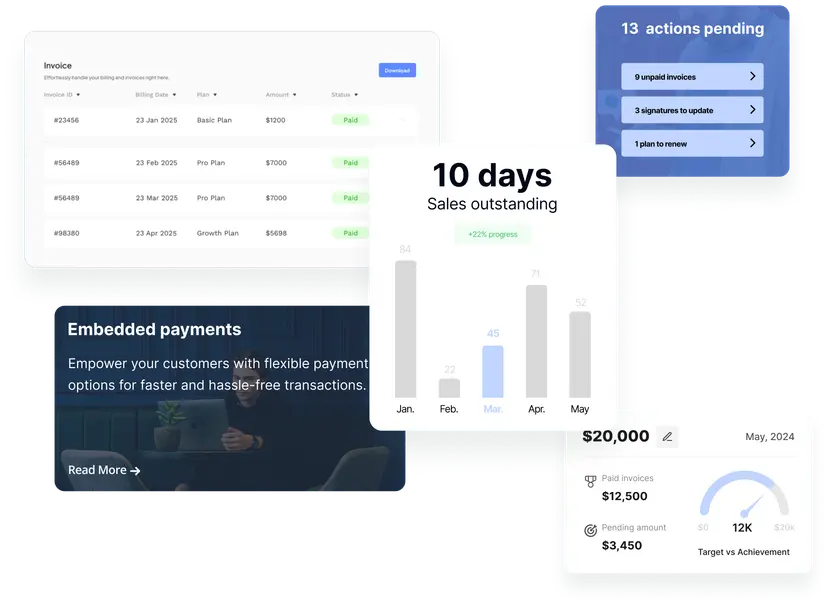

| Real-Time Tracking & Reporting | Manual spreadsheets (error-prone) | Real-time dashboard with collection insights & tax reporting |

| Scalability for Growing SMEs | Limited — time and resource-heavy | Scalable — ideal for small & medium businesses expanding across |

Why Automated Invoicing is Better for SMEs

- Automated invoicing software reduces errors by eliminating manual input.

- Automated invoice processing accuracy ensures invoices meet VAT and FTA standards.

- Reduce invoicing errors for small businesses—no duplicates, no missed payments.

- Enjoy top invoice automation software benefits: faster payments, fewer disputes, and stress-free audits.

Upfront’s invoice automation software is designed for SMEs to cut down invoicing mistakes, guarantee tax compliance, and boost cash flow—making manual invoicing obsolete.

Reduce Invoicing Errors With Upfront

If you’re an SME , Upfront’s automated invoicing software offers everything you need to reduce errors and streamline billing:

- Automated data entry & tax calculations

- Seamless integration with QuickBooks, Xero, Zoho Books

- Real-time invoice status tracking

- FTA-approved, VAT-compliant e-invoicing (with QR codes)

- Automated reminders and payment links to customers

Dubai-based SMEs using Upfront have reported:

- 50% fewer invoice disputes

- 20% faster cash flow cycles

- Zero VAT penalties or audit risks

Why risk costly mistakes? Switch to automated invoicing today and enjoy error-free, faster payments.

FAQs: Automated Invoicing Software Reduces Errors for UAE SMEs

1. How does automated invoicing software reduce errors for small businesses?

Automated invoicing eliminates manual data entry, auto-calculates totals and VAT, syncs with your CRM, and applies business rules consistently—preventing common errors like typos, duplicate invoices, and misapplied tax rates.

2. Can invoice automation prevent duplicate or missing invoices?

Yes. Automated invoice processing accuracy includes validation checks that ensure each invoice is unique, complete, and compliant with UAE VAT and FTA regulations.

3. How does invoice automation software improve billing accuracy?

Automation applies pre-set pricing, tax, and discount rules, ensuring that every invoice generated is correct and consistent—reducing the need for corrections or credit notes.

4. Is automated invoicing affordable for small UAE businesses?

Yes. Upfront’s plans start at AED 99/month—an affordable solution that saves time, reduces errors, and ensures compliance for SMEs.

5. What accounting tools can be integrated with automated invoicing software?

Upfront seamlessly integrates with QuickBooks, Xero, Zoho Books, and other ERP systems—making it easy to automate AR processes without changing your existing setup.

Final Thoughts: Choose Automation to Reduce Invoicing Errors in SMEs

Manual invoicing is no longer suitable for growing SMEs in markets—where VAT laws are complex, and customer expectations are high. Automated invoicing software reduces errors, prevents mistakes, ensures tax compliance, and speeds up payments—helping you focus on growth, not admin work.

→ Error elimination: Automated Invoicing Reduces Errors → Touchless processing: Automated Invoice Processing → Real-time control: Automated Invoice Tracking → Centralized command: Digital Invoice Management → SME evolution: Future Automated Invoicing SMEs