What is financial optimization?

Financial optimization is the process of improving your business’s financial performance by increasing efficiency, reducing waste, and leveraging tools like accounts receivable automation, cash flow forecasting tools, and AI in finance operations to maximize profitability and support sustainable growth.

Financial optimization is more than just a buzzword—it’s a vital strategy for businesses looking to thrive in an increasingly complex and competitive marketplace. By streamlining processes, reducing waste, and leveraging data-driven insights, financial optimization helps organizations maximize profitability and achieve sustainable growth. As we look ahead to 2025, understanding its significance and implementing effective strategies—such as accounts receivable automation, working capital improvement, and deploying financial dashboards for SMEs—will be crucial for businesses of all sizes.

This article explores the meaning of financial optimization, why it’s important, and how businesses can improve their financial performance using the latest cash flow forecasting tools and AI in finance operations. We’ll also discuss the technologies and best practices that make optimization more achievable than ever.

What is the meaning of financial optimization for Businesses?

Financial optimization refers to the process of improving financial processes, systems, and outcomes to maximize efficiency and profitability. Unlike basic cost-cutting measures, it focuses on creating long-term value while maintaining operational effectiveness.

The goal is to align financial resources with business objectives, ensuring smoother operations and sustainable growth with support from solutions like financial dashboards for SMEs and advanced AI in finance operations.

Differences between cost-cutting vs optimization

It’s essential to distinguish between financial optimization and cost-cutting. While cost-cutting often involves reducing expenses indiscriminately, optimization uses a strategic approach by balancing cost reduction with performance improvement, incorporating tools such as cash flow forecasting tools and working capital improvement methods. This ensures businesses remain efficient without compromising critical functions.

Strategic vs. Operational Financial Efficiency

Financial optimization operates on two levels:

- Strategic Efficiency: Long-term planning and aligning financial resources with business goals, such as entering new markets or launching innovative products. Financial dashboards for SMEs provide essential overviews for strategic decisions.

- Operational Efficiency: Day-to-day management of expenses, cash flow optimization strategies, and resource allocation to enhance immediate financial performance. Utilizing accounts receivable automation and working capital improvement solutions can enhance operational efficiency.

Implementing financial KPIs for business growth—monitored through dashboards and automation—plays a key role in measuring both strategic and operational efficiency.

Metrics like return on investment (ROI), profit margins, and accounts receivable turnover offer valuable insights for ongoing improvement.

Key Areas of Financial Optimization

Cash Flow Management

Efficient cash flow management ensures businesses can meet their short-term obligations while investing in growth opportunities. Leveraging cash flow forecasting tools helps predict income and expenses, enabling better decision-making at all levels.

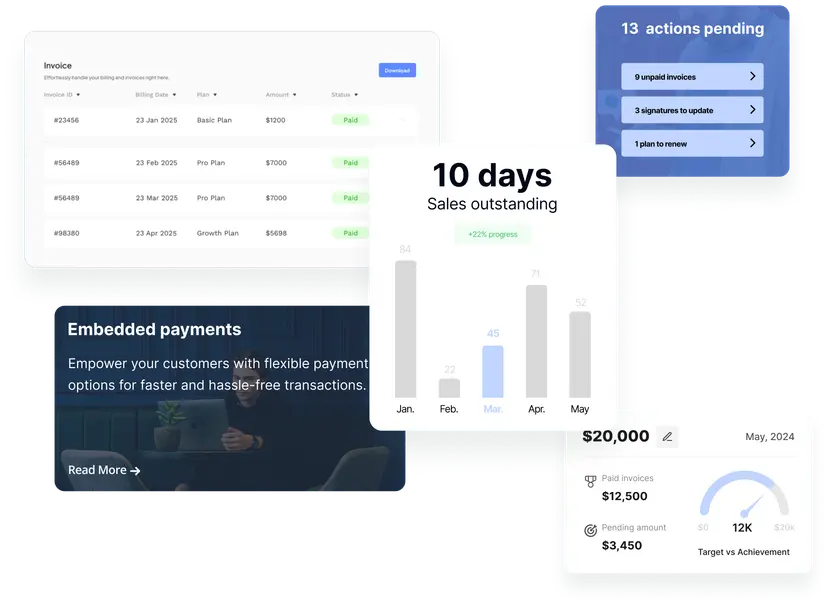

Businesses can also integrate accounts receivable automation solutions like UPFRONT to accelerate payments and improve cash flow, directly supporting working capital improvement.

Accounts Receivable and Payable Automation

Manual processes in accounts receivable (AR) and payable (AP) are not just time-consuming—they’re prone to errors. Adopting accounts receivable automation streamlines these functions, reduces inefficiencies, and accelerates financial cycles.

Platforms such as UPFRONT facilitate payment tracking, AR automation, and streamlined reconciliation, working alongside financial dashboards for SMEs to offer clear financial visibility.

Expense Tracking and Control

Understanding where your money goes is the first step toward financial optimization. Expense management tools, integrated with financial dashboards for SMEs, can help reduce financial waste and allocate resources to high-priority areas. Automated solutions and AI in finance operations also help minimize human error and uncover savings opportunities.

Optimizing Working Capital

Optimizing working capital is about maintaining the right balance between current assets and liabilities, ensuring liquidity and freeing up capital for strategic investments. Working capital improvement solutions—including accounts receivable automation and robust financial dashboards for SMEs—provide actionable insights to fine-tune these balances.

Tax and VAT Compliance

For SMEs operating in regions like the UAE and GCC, staying compliant with tax and VAT regulations is critical. Leveraging financial dashboards for SMEs can simplify tax reporting by providing real-time updates and compliance insights, supporting broader financial optimization efforts.

Financial Optimization Tools

Financial planning and analysis tools have evolved significantly, offering businesses powerful ways to optimize their finances by leveraging cash flow forecasting tools and seamless integration. Here are some essential tools:

- Accounts Receivable Automation Platforms: Streamlining AR processes with solutions like UPFRONT accelerates cash inflows and reduces days receivable. Accounts receivable automation ensures businesses get paid faster and improves financial predictability.

- Forecasting Dashboards:Financial dashboards for SMEs, often equipped with advanced cash flow forecasting tools, provide a clear view of future cash flow and help businesses plan effectively.

- Expense Management Tools: These tools offer deeper visibility into expenditures. By integrating with AI in finance operations, businesses can cut unnecessary costs and boost efficiency.

- ERP and Accounting Integrations: Connecting financial dashboards for SMEs and AI in finance operations ensures data consistency and eliminates manual errors.

- Working Capital Improvement Solutions: These enable real-time tracking and management of assets and liabilities, supporting cash reserves and investment opportunities.

Financial Optimization Benefits for SMEs and Enterprises

Both SMEs and Mid enterprises stand to gain significant benefits from financial optimization:

- Improved Profitability: Enhanced efficiency translates directly into lower costs and higher profits. Accounts receivable automation not only speeds up payments but also increases revenue predictability.

- Faster Decision-Making: Real-time data from financial dashboards for SMEs and insights from AI in finance operations allow leaders to act quickly and confidently.

- Reduced Operational Risk: Automated processes, backed by cash flow forecasting tools, help minimize errors and ensure greater reliability.

- Higher Investor Confidence: When financial metrics are presented clearly through dashboards and supported by automation, a financially optimized business becomes far more attractive to investors and stakeholders.

For SMEs, in particular, financial efficiency strategies—bolstered by technology—can mean the difference between survival and growth. Automation tools and AI in finance operations play a key role in leveling the playing field.

AI and Automation in Financial Optimization

The role of AI in finance operations is expanding rapidly, bringing unparalleled opportunities for financial optimization. Here’s how AI and automation are transforming finance:

Predictive Cash Flow

With accurate cash flow forecasting tools powered by AI, businesses can predict future liquidity, identify trends, and avoid shortfalls. This capability supports both immediate operational decisions and longer-term strategic planning.

Automated Invoicing

AI in finance operations streamlines invoicing, reduces human error, and speeds up cash collection—critical for ongoing working capital improvement. Accounts receivable automation, integrated with payment tracking, keeps revenue flowing.

Scenario Planning with Real-Time Data

Financial dashboards for SMEs, enhanced by AI, enable scenario modeling with live data. This empowers more effective financial planning and risk management, so businesses can prepare for multiple outcomes and make swift decisions.

Financial Optimization FAQs

How can I improve my business’s financial performance?

Start by implementing cash flow optimization strategies using cash flow forecasting tools and accounts receivable automation. Use financial dashboards for SMEs to monitor KPIs and automate repetitive processes for ongoing working capital improvement.

What is financial process optimization?

A: Financial process optimization means evaluating and refining each step in your financial workflows, including budgeting, collections, cash flow forecasting, and financial reporting. Automating these processes and integrating AI and real-time dashboards increases efficiency and minimizes errors.

What tools help with financial optimization?

Key tools include accounts receivable automation, cash flow forecasting tools, financial dashboards for SMEs, expense management apps, and AI in finance operations for analytics and decision-making.

How does cash flow optimization improve profitability?

By improving visibility into income and expenses through cash flow forecasting tools, businesses can allocate resources more efficiently, reduce waste, and confidently invest in growth—all boosting profitability.

What are the benefits of financial automation for SMEs?

Automation saves time, reduces costs and errors, and improves financial efficiency for SMEs. Solutions like accounts receivable automation and AI-powered financial dashboards for SMEs also provide instant insights and enable data-driven decisions.

Is financial optimization the same as cost reduction?

No. Financial optimization is a holistic approach that combines cost management, working capital improvement, strategic investments, and automation to achieve superior results.

How can AI help with financial optimization?

AI in finance operations automates routine tasks, provides predictive insights, and enables real-time scenario planning through financial dashboards for SMEs and integrated analytics tools.

Start Optimizing with UPFRONT – Automate, Analyze, Accelerate

Financial optimization is no longer optional—it’s a necessity in 2025. By adopting strategies, tools, and technologies like accounts receivable automation, cash flow forecasting tools, working capital improvement methods, financial dashboards for SMEs, and AI in finance operations, businesses can enhance performance and drive sustainable growth. Start your optimization journey today with UPFRONT’s innovative financial solutions. Automate your processes, analyze your data, and accelerate your results.

→ Adoption roadmap: Challenges in AR Implementation→ Volume solutions: Best AR Software High Volume→ Compliance mastery: AR Automation UAE→ Financial leadership: Financial Optimization Guide