Why AR Process Efficiency Matters for Cash Flow Management

In today’s cash-driven business environment, your Accounts Receivable (AR) process efficiency can make—or break—your cash flow. As a fintech consultant working with companies on AR automation and digital finance transformation, I can confidently say: improving AR is not just about faster payments. It’s about freeing trapped cash, lowering risk, and building real-time financial visibility.

This guide will help you enhance AR process efficiency by showing how to reduce manual work, speed up collections, and optimize every touchpoint of the receivables journey—using the best tools and proven strategies.

Why AR Process Efficiency Matters for Cash Flow Management

Poor AR efficiency directly slows cash flow. Overdue invoices, manual reconciliation, and slow collections leave money stuck in the system instead of your bank account.

By improving AR efficiency, you can:

- Reduce Days Sales Outstanding (DSO)

- Improve working capital availability

- Lower collection costs

- Minimize bad debt write-offs

When you set up your accounts receivable process correctly—whether in Zoho Books, Xero, QuickBooks or others—your collections accelerate, customer satisfaction rises, and financial reporting gets sharper.

7 Strategies to Enhance AR Process Efficiency

As an advisor helping companies in manufacturing, SaaS, and distribution, these are the seven methods I recommend to boost AR performance:

1. Automate Invoice Delivery and Tracking

Manual invoices cause delays. Modern AR platforms offer:

- Instant e-invoicing

- Real-time tracking

- Customer self-service portals

Example: In SAP, automating invoices via AR modules cuts processing time by 40%.

2. Improve Collection Efficiency with Smart Dunning

Wondering how to improve collection efficiency ?

Use automated reminders (dunning) tailored to customer payment history , reducing overdue accounts without personal calls.

AR collection meaning?

It’s the structured process of chasing outstanding receivables, not random follow-ups. Smart software manages this daily.

3. Define Clear AR Procedures and Documentation

A documented accounts receivable procedures manual ensures every team member follows the same process—reducing errors and disputes.

Include:

- Credit approval process

- Invoice issuing steps

- Payment term setting

- Dispute resolution workflows

4. Align Sales, Finance, and Customer Service Teams

Finance should never chase invoices alone. When Sales and AR teams align on payment terms and client risk, disputes drop and payments speed up.

5. Leverage Data: AR Aging Reports and Turnover Analysis

You can’t improve what you don’t measure. Analyze:

- AR aging reports

- Receivables Turnover Ratio (the formula for AR efficiency)

Receivables Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

A higher ratio = more efficient collections.

6. Use Technology to Automate Reconciliation

AR reconciliation in QuickBooks, Zoho Books or other ERP systems saves hours. Automating the cash application process ensures faster matching of payments to invoices, reducing unapplied cash and errors.

7. Offer Flexible Payment Options

Clients pay faster when it’s easy. Provide:

- Credit cards

- Virtual Iban

- Digital wallets

- Online customer portals

This directly improves accounts receivable turnover and cash flow.

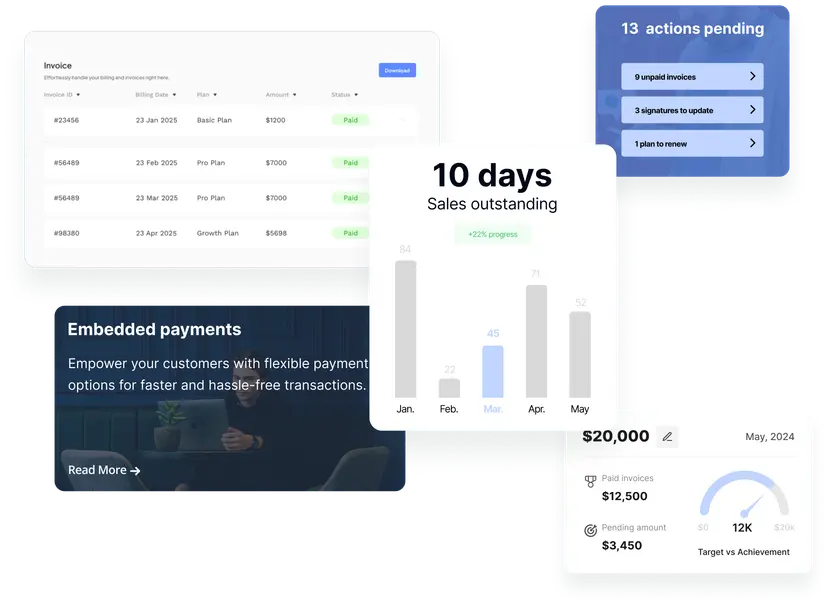

5 Time-Saving AR Automation Tools for 2025

These tools are reshaping AR efficiency:

- AR Automation Platforms

For automated invoicing and payment portals. - ERP-integrated AR Modules

For streamlined processes across sales, finance, and AR. - Automated Dunning Systems

To improve collections without manual effort. - AI-driven Cash Application Tools

For real-time payment matching and bank reconciliation. - Real-time AR Reporting Dashboards

For instant insights into DSO, turnover, and disputes.

Key Benefits of Optimizing AR Workflows

When you enhance your AR process, you get:

- Faster Cash Flow

- Lower Operating Costs

- Improved Forecast Accuracy

- Stronger Customer Relationships

- Reduced Bad Debts

Knowing how to improve cash flow through AR process efficiency is essential for scaling businesses that can’t afford working capital gaps.

Top FAQs: Enhance AR Process Efficiency

1. How to make accounts receivable more efficient?

- Automate invoicing and tracking

- Streamline collection steps

- Use aging analysis and turnover ratio metrics

- Offer digital payment portals

2. How can you increase the efficiency in the collection process?

Set clear credit terms, automate dunning reminders, and prioritize overdue accounts based on risk. This is how to follow-up accounts receivable efficiently.

3. What is the formula for AR efficiency?

The formula is:

Receivables Turnover Ratio = Net Credit Sales ÷ Average Accounts Receivable

A higher value means receivables are collected faster—a key sign of AR efficiency.

4. What are the common techniques used to improve process efficiency?

- Automation (invoice, dunning, reconciliation)

- AR reporting (aging, turnover)

- Documented AR procedures manual

- Cross-department collaboration (Sales-Finance)

5. How to set up an accounts receivable process?

- Define clear credit policies

- Automate invoicing via ERP

- Establish AR procedures and workflows

- Implement aging analysis and collection strategies

Final Thoughts: AR Efficiency is Cash Flow Power

If there’s one thing I’ve learned advising finance teams—it’s that AR inefficiency quietly drains companies. But with automation, data-driven processes, and smart follow-up, you unlock capital, boost performance, and delight customers.

Mastering AR efficiency is mastering your business’s financial strength.

→ Unified data power: AR-CRM Integration → End-to-end efficiency: Invoice to Cash Workflow → Payment ecosystem: Embedded Payment Solutions → System harmony: Enhancing AR Processes → Subscription simplicity: Recurring Payments Setup