How AR Automation Impacts Industries: Cash Flow, Efficiency & Growth

Efficient cash flow is the lifeblood of any business — but managing accounts receivable (AR) can be a time-consuming and error-prone task. This is where accounts receivable automation steps in as a game-changer. From streamlining labor-intensive processes to improving payment timelines, the AR automation impact is revolutionizing industries like manufacturing, retail, SaaS, healthcare, and more. Companies leveraging accounts receivable automation by industry are not only optimizing workflows but also reducing Days Sales Outstanding (DSO) with AR automation significantly.

Read on to discover the specific challenges faced by each sector and how AR automation in manufacturing, retail, SaaS, healthcare, and professional services can make a game-changing impact on your accounts receivable process improvement.

What is Accounts Receivable Automation?

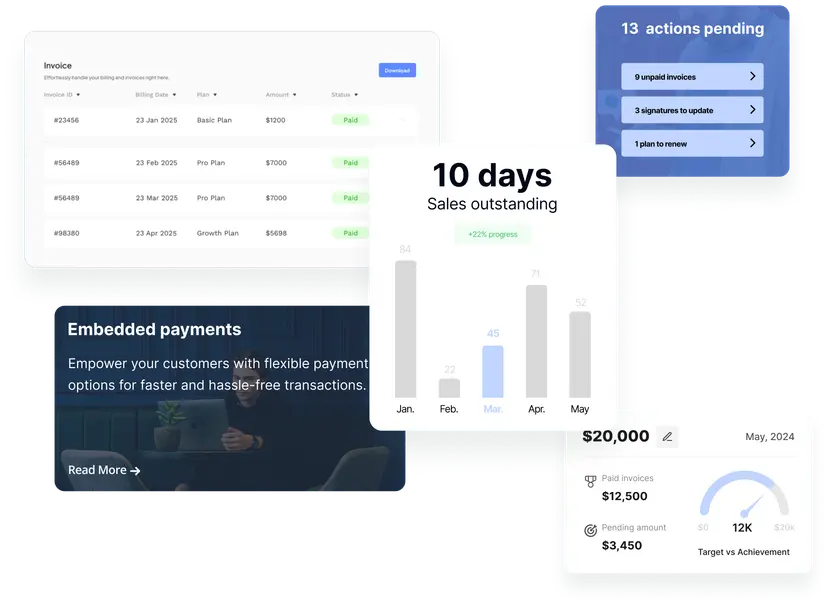

Accounts receivable automation refers to using digital tools and software solutions to automate tasks such as invoicing, payment reminders, and reconciliation. This strategic move leads to AR automation impact in the form of eliminated manual entry, fewer errors, and enhanced cash flow transparency. Leading platforms like UPFRONT provide tailor-made solutions for accounts receivable automation by industry, helping businesses get paid faster while ensuring accuracy, regulatory compliance, and sustainable workflow improvements.

Why AR Automation Matters

- Efficiency Gains: Automated processes drive significant accounts receivable process improvement by reducing manual workload and freeing teams to focus on strategic activities.

- Faster Payments: With automated invoicing and reminders, businesses consistently reduce DSO with AR automation and improve long-term cash flow health.

- Reduced Errors: Automation minimizes human mistakes in billing and payment tracking, enhancing accuracy across all industries.

Let’s explore the AR automation impact in specific sectors to see how these solutions drive industry-specific advantages.

AR Automation in Manufacturing

Challenges in Manufacturing AR

Manufacturers face unique accounts receivable hurdles:

- Complex ERP Systems: Integrating invoicing with ERP systems can be labor-intensive.

- Long Billing Cycles: Payments are often tied to project milestones, causing cash flow delays.

- Custom Pricing Models: Contracts often require tiered pricing, complicating invoice generation.

Impact of AR Automation in Manufacturing

Enhanced Workflow Integration

AR automation in manufacturing seamlessly connects with existing ERP systems, enabling smooth data flow and faster invoice processing, directly contributing to measurable AR automation impact.

Improved Cash Flow

Automation accelerates the collection process, offering an effective accounts receivable process improvement and ensuring on-time cash inflow—especially crucial in project-milestone scenarios.

Accurate Billing

Automated pricing and contract management ensure invoice accuracy and help manufacturers reduce DSO with AR automation.

AR Automation in Retail & Wholesale

Challenges in Retail & Wholesale AR

Retailers and wholesalers struggle with:

- High Invoice Volumes: Daily invoice spikes are laborious and error-prone.

- Seasonal Peaks: Unpredictable demand surges stretch AR teams thin.

- Credit Risk: Managing buyer creditworthiness adds complexity and risk.

Impact of AR Automation in Retail

Scalable Solutions

With AR automation in retail, fluctuating invoice volumes are handled efficiently—even during seasonal surges—resulting in substantial accounts receivable process improvement.

Real-Time Risk Insights

Automation offers instant credit risk analysis, helping businesses proactively reduce risk and improve the AR automation impact on stability.

Faster Collections

Automated payment reminders and accessible portals help reduce overdue invoices and reduce DSO with AR automation in retail and wholesale.

AR Automation in SaaS & Subscription Businesses

Challenges in SaaS AR

For subscription models, SaaS companies face:

- Recurring Billing Issues: Subscription invoicing requires precise automation.

- Payment Failures: Failed charges disrupt cash flow and require rapid resolution.

- High Churn Rates: Inefficient billing can lead to lost customers.

Impact of AR Automation in SaaS

Subscription Management

AR automation in SaaS platforms like UPFRONT automate recurring billing, drastically improving payment accuracy and reliability—proving the AR automation impact on recurring revenue businesses.

Payment Recovery

Failed payment alerts and automated retry features are essential for SaaS accounts receivable process improvement.

Customer Retention

Error-free, streamlined billing powered by AR automation in SaaS boosts customer trust and directly reduces churn, further reducing DSO with AR automation.

AR Automation in Healthcare

Challenges in Healthcare AR

Healthcare providers face:

- Insurance Delays: Claims often lead to reimbursement lag.

- Patient Payment Complexities: Patient collections can be challenging.

- Compliance Requirements: Aligning AR processes with strict regulations.

Impact of AR Automation in Healthcare

Faster Insurance Reconciliation

AR automation in healthcare automates claims management and payment tracking, delivering substantial accounts receivable process improvement and reducing cash flow bottlenecks.

Streamlined Billing Portals

User-friendly, automated payment platforms elevate patient experiences and collection rates.

Regulatory Compliance

AR automation ensures healthcare compliance, mitigating regulatory risk and contributing to broad AR automation impact in the sector.

AR Automation in Construction & Engineering

Challenges in Construction AR

Long, milestone-driven projects pose these AR challenges:

- Lien Risk: Delays can lead to legal disputes.

- Complex Contracts: Multistage billing complicates payments.

- Subcontractor Payments: Coordinating payables and receivables is demanding.

Impact of AR Automation in Construction

Milestone Automation

AR automation in construction auto-generates milestone-linked invoices for timely, accurate billing and accelerated collections.

Lien Prevention

By expediting collections, construction firms reduce lien risks with AR automation, demonstrating powerful accounts receivable process improvement.

Improved Visibility

Dashboards track AR status, supporting informed project management and rapid dispute resolution.

AR Automation in Professional Services

Challenges in Professional Services AR

Agencies, law firms, and accountants face:

- Time-Tracked Billing: Accurate time-to-invoice matching is vital.

- Late Payments: Delays hurt cash flow and business growth.

- Custom Agreements: Each client may require unique billing setups.

Impact of AR Automation in Professional Services

Integrated Billing

AR automation extracts tracked time for instant, accurate invoices—delivering major AR automation impact for professional services.

Payment Reminders

Clients receive automated reminders, which helps reduce DSO with AR automation and improve payment speed.

Accurate Customization

Automation aligns with custom contracts and agreements, reducing manual work across all accounts receivable automation by industry applications.

Industry Impact Comparison

AR Automation ROI Across Sectors

| Metric | SaaS | Manufacturing | Services |

|---|---|---|---|

| Primary Pain Point | Subscription churn | PO matching errors | Billable hour leakage |

| Key Feature | Recurring billing | ERP cash application | Mobile payment portals |

| DSO Reduction | 22-30% | 25-35% | 20-28% |

| UAE/GCC Specialization | MENA VAT compliance | ZATCA e-invoicing | Arabic/English portals |

5 Strategic Benefits Uniting All Industries

- Predictable Cash Flow AI forecasts cash positions with 90% accuracy using historical patterns

- Scalable Compliance Auto-updates for VAT, ZATCA, and GDPR rules

- Enhanced CX Branded portals increase repeat business by 23%

- Resource Liberation Saves 18+ weekly hours on manual tasks

- Real-Time Analytics Tracks industry KPIs: SaaS MRR, manufacturing WCR, service utilization

Struggling with Industry-Specific AR Complexities?

UPFRONT delivers tailored automation for SaaS, manufacturing, and service firms with UAE/GCC compliance and ERP integration.

Get Industry-Specific Demo →How UPFRONT Transforms the Accounts Receivable Landscape

No matter the vertical, UPFRONT leads the way in modern accounts receivable automation by industry. Here’s how the platform creates a powerful AR automation impact:

- Faster Collections: Automated tools support on-time invoicing and prompt payments, reducing DSO with AR automation.

- Integrated Solutions: From ERPs in manufacturing to subscription management in SaaS, UPFRONT’s AR automation integrates across industries.

- User-Friendly Portals: Enhanced customer experiences drive smoother accounts receivable process improvement.

By reducing manual errors, boosting workflow efficiency, and providing data-driven insights, UPFRONT empowers businesses to achieve outstanding AR automation impact and efficiency.

FAQs – AR Automation Industry Impact

1. What is the AR automation industry impact across different sectors?

The AR automation industry impact is significant in manufacturing, finance, healthcare, and retail. In manufacturing, AR-driven automation improves equipment maintenance, reduces errors, and enhances production efficiency. In finance, AR automation optimizes accounts receivable workflows, speeds up collections, and improves cash flow visibility.

2. How does AR automation benefit manufacturing companies?

AR automation benefits in manufacturing include real-time machine monitoring, predictive maintenance, error reduction, and improved training through augmented reality overlays. These benefits lead to lower downtime, better quality control, and higher operational efficiency across production lines.

3. What is the role of AR automation for receivables management?

AR automation for receivables streamlines invoicing, payment reminders, and cash flow forecasting. Businesses using AR automation reduce Days Sales Outstanding (DSO), minimize human error, and achieve faster, more predictable payment cycles, improving their financial health and working capital.

4. How does edge computing enhance AR automation solutions?

Edge computing AR automation processes data closer to the source (machines, sensors, or AR devices) for faster real-time decisions, lower latency, and enhanced security. This approach is especially beneficial in industrial environments where instant analysis is critical for quality control and maintenance alerts.

5. What are the cost-saving impacts of AR automation on businesses?

Companies experience lower labor costs, reduced downtime, fewer errors, and improved asset utilization. In manufacturing, AR automation can decrease operational expenses by up to 30% while increasing throughput and product quality.

6. How does AR automation affect workforce roles and skills requirements?

AR automation changes job roles by automating repetitive tasks but creates new opportunities in system design, data analysis, and AR development. Manufacturers and financial firms must invest in upskilling employees to work alongside AR-enabled systems.

7. What are the main challenges in adopting AR automation industry-wide?

Common challenges include high initial investment, system integration complexity, cybersecurity risks, and the need for workforce reskilling. Overcoming these barriers is crucial to realizing the full AR automation industry impact.

8. How is predictive maintenance supported by AR and edge computing automation?

Edge computing AR automation enables predictive maintenance by analyzing machine data in real time to predict failures before they occur, reducing unexpected downtime and costly repairs in manufacturing plants.

9. What future trends are shaping AR automation in industries?

The future of AR automation industry impact includes wider adoption of Industry 4.0, AI-powered process optimization, and the use of edge computing AR automation for faster, smarter decision-making in real-time environments.

10. How can companies prepare for successful AR automation integration?

Businesses should start with ROI analysis, pilot AR automation projects in high-impact areas (like manufacturing or receivables), invest in cybersecurity, and provide employee training to adapt to new AR-enhanced workflows.

Final Thoughts

Accounts receivable automation delivers measurable benefits across industries, including improved efficiency, optimized cash flow, and fewer operational headaches. Whether you’re in manufacturing, SaaS, healthcare, or any sector, investing in AR automation in manufacturing, retail, SaaS, and beyond offers significant accounts receivable process improvement and helps reduce DSO with AR automation.

Take control of your cash flow today. Discover how UPFRONT’s accounts receivable automation by industry can transform your business operations and deliver real, lasting AR automation impact.

→ Future-proof integration: AI in AR Automation→Compliance simplified: E-Invoicing in UAE→ Next-gen processing: Future of AR Automation→Seamless adoption: Integrating AR Automation→ Eliminate bottlenecks: AR Automation Showdown