How does AI AR Automation reduce late payments in accounts receivable?

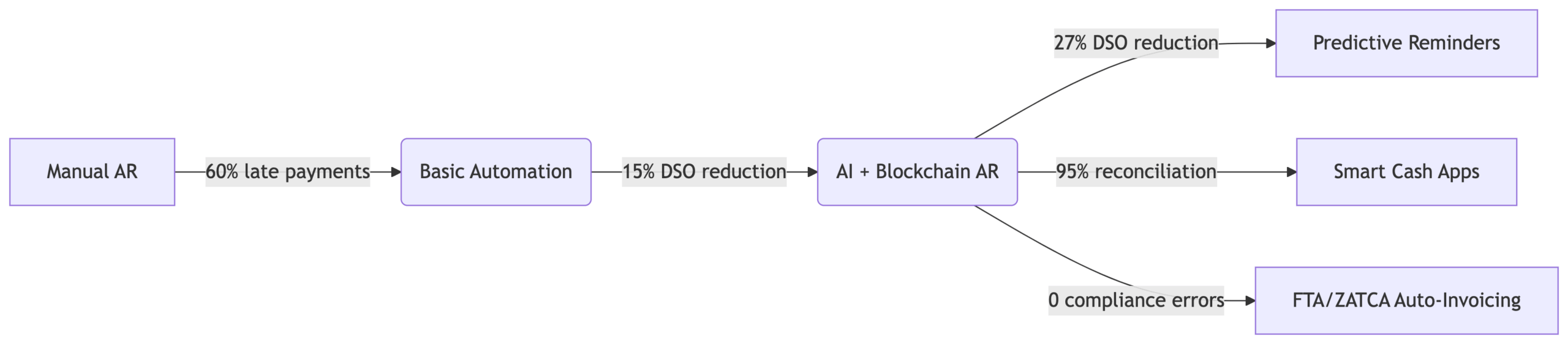

60% of late payments stem from manual invoicing errors (PYMNTS 2025). AI-driven AR automation eliminates these errors by:

- Predicting payment delays using behavioral analytics

- Auto-matching payments to invoices with 95% accuracy

- Sending hyper-personalized reminders via optimal channels

- Cutting Days Sales Outstanding (DSO) by 27% on average

The $500B Problem: Why Manual AR Crushes UAE Businesses

Dubai’s booming economy masks a cash flow crisis. GCC businesses lose $11,005 monthly per $5M revenue due to:

- 76-day average payment delays eroding liquidity

- 5-7% revenue leakage from reconciliation errors in manual processes

- 20+ weekly hours wasted on repetitive chasing instead of strategy

Traditional “automation” fails because:

“Basic rule-based tools send generic reminders but can’t predict risks or personalize outreach. When 42% of UAE customers pay late due to complex approval chains, you need intelligence, not just automation.” — Finance Automation Strategist, UPFRONT

AI vs. Traditional Automation: The Intelligence Revolution

Evolution of AR Technology in GCC Markets

| Capability | Manual AR | Basic Automation | AI-Driven AR (UPFRONT) |

|---|---|---|---|

| Payment Prediction | ❌ Guesswork | ❌ Fixed rules | ✅ Behavioral analytics + ML models |

| Reconciliation Accuracy | 60-70% | 80-85% | ✅ 95%+ auto-match rate |

| Compliance Handling | ❌ Manual adjustments | ⚠️ Partial templates | ✅ Auto-FTA/ZATCA e-invoices + Arabic support |

| DSO Reduction | 0-5% | 10-15% | ✅ 27% avg reduction |

How UPFRONT’s AI Engine Transforms 4 Core AR Functions

1️⃣ Predictive Cash Flow Forecasting

UPFRONT’s ML algorithms analyze:

- Historical payment patterns of each customer

- Industry-specific seasonality (e.g., retail peaks during Dubai Shopping Festival)

- Macroeconomic signals like oil price shifts impacting GCC payers

Result: 90% accurate cash flow forecasts, letting you optimize working capital or secure early financing .

2️⃣ Intelligent Collections Management

No more “spray and pray” reminders. Our AI:

- Scores invoices by payment risk (high-value/low-urgency vs. low-value/high-risk)

- Selects optimal channel/time per customer: WhatsApp for UAE SMEs, email for corporates, calls for 90+ day delays

- Generates personalized messages: Firm tone for chronic late-payers, supportive for temporary issues

3️⃣ Self-Learning Cash Application

Traditional rules fail with:

- Partial payments

- Mismatched references (“INV123” vs “Invoice June-123”)

- Multi-currency transactions

UPFRONT’s NLP-powered tool:

“Uses context from 1,000+ past payments to auto-reconcile even complex transactions, slashing manual work by 82%” — UAE Automotive Parts Case Study

4️⃣ Blockchain-Powered Compliance

With UAE’s mandatory e-invoicing by 2026, our platform:

- Generates FTA-compliant invoices with digital QR codes/Arabic fields

- Stores immutable audit trails encrypted.

- Auto-archives for 5+ years meeting audit requirements

Why UAE/GCC Businesses Choose UPFRONT

Seamless Local Integration

- ERP Sync: Xero, Zoho Books, QuickBooks, and others.

- Local Payments: Aani (UAE), ApplePay, STC Pay

- GCC Compliance: VAT/ZATCA calculations, Arabic/English invoices

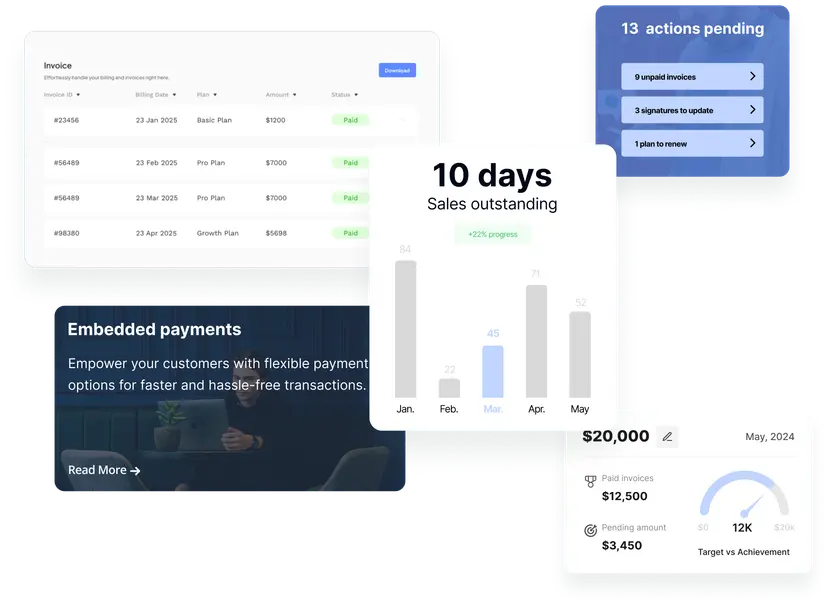

Proven ROI for High-Volume Businesses

A Dubai wholesaler processing 900+ monthly invoices achieved:

| Metric | Improvement |

|---|---|

| Invoice Processing | 82% faster |

| Reconciliation Errors | less than 5% in 6 months |

| Collection Calls | ↓75% |

| DSO | ↓27% |

Struggling with FTA/ZATCA E-Invoicing Deadlines?

UPFRONT guarantees compliant Arabic/English invoices, blockchain audit trails, and auto-archiving — eliminate compliance risks in 48 hours.

AI AR Automation FAQs

1. What is AI AR automation and how does it reduce late payments?

AI AR automation uses machine learning to predict payment delays, auto-match invoices with 95% accuracy, and send personalized reminders at optimal times via preferred channels like WhatsApp or email—cutting late payments by 65%.

2. How does UPFRONT’s AI improve cash flow forecasting?

Its ML models analyze historical payment trends, industry seasonality, and macroeconomic factors (e.g., oil price fluctuations) to deliver cash flow forecasts with 90% accuracy.

3. Can AI AR automation handle complex VAT and e‑invoicing requirements in the UAE?

Yes. The platform auto-applies 5% UAE VAT, supports reverse‑charge for GCC transactions, embeds digital tax stamps, and generates FTA/ZATCA-compliant Arabic/English e‑invoices with encrypted audit trails.

4. How quickly can businesses implement UPFRONT’S AI AR automation?

Most UAE clients go live within 1 day: ERP integration (minutes 10–12), AI rule setup (minutes 10-15), followed by training and testing (minutes 30).

5. Is AI AR automation suitable for small and mid‑sized businesses?

Absolutely. The Starter Plan, at $39/month, covers 100 invoices, AI-led email reminders, UAE VAT compliance, and Slack support—tailored for SMEs

6. Does AI replace AR teams?

No, it enhances AR teams by automating repetitive tasks—data entry, invoice matching, reconciliation—freeing staff to concentrate on strategic activities and reducing burnout.

7. What returns can businesses expect from AI AR automation?

A Dubai wholesaler saw an 82% faster processing rate, almost zero reconciliation errors over six months, a 75% reduction in collection calls, and a 27% decrease in DSO

8. How does AI support compliance with GCC e‑invoicing mandates?

UPFRONT auto-generates FTA/ZATCA-compliant Arabic/English invoices, includes QR codes, and stores them on a secure and structured vault for immutable audit trails, with auto-archiving for at least 5 years.

9. What future innovations are integrated into UPFRONT’s platform?

It’s building toward secure contracting and smartly (auto-triggered payments), real-time settlements (via UAE’s Aani/Saudi’s SARIE), and predictive dispute detection to flag invalid deductions—helping clients gain over 40% efficiency.

Future-Proof Your AR: Where AI Meets Security & Real-Time Payments

The GCC’s $1.3T digital economy (DIFC 2024) demands next-gen tools:

- Smart Contracts: Auto-trigger payments upon delivery confirmation

- Real-Time Settlements: UAE’s Aani/Saudi’s SARIE enable <5 sec payments

- Predictive Deductions: Flag invalid disputes before they occur

“UAE businesses using AI AR automation gain 40%+ efficiency advantages over peers” — Forrester AI Use Cases Report 2025

Ready to slash your DSO by 27%?

Get a Free ROI Analysis showing projected cash flow gains for your UAE/GCC business.

Next to Know

→ Cash flow mastery: AR Automation vs. AP Automation

→Transform efficiency: AR Automation Industry Impact

→ Next-gen processing: Future of AR Automation

→Seamless adoption: Integrating AR Automation

→ Eliminate bottlenecks: AR Automation Showdown