Getting Your Systems Talking: Integrating AR Automation with Your ERP/Accounting Software

Integrating AR automation with ERP/accounting systems enables real-time data sync, eliminates manual entry errors, and improves cash flow visibility. Key integration points include customer data, invoices, payments, and ledger updates—critical for UAE VAT compliance and operational efficiency.

Why AR Automation Software Integration is Non-Negotiable in 2025

Running standalone AR software is like using a sports car with square wheels—it might look powerful, but you’ll never hit top speed. Disconnected systems create friction at every turn. Here’s how integration fixes what’s broken:

5 Costly Problems Caused by Non-Integrated AR Systems

1. Double Data Entry = Double Trouble

- The Problem: Manually typing invoice details, customer records, and payments into multiple systems wastes 15+ hours per week (APQC research).

- The Risk: Every manual entry is a chance for errors—30% of accounting mistakes stem from duplicate data input (Gartner).

- Integration Fix: Sync once, and updates flow automatically between AR, ERP, and accounting software.

2. Mismatched Data, Mangled Reconciliations

- The Problem: Customer A’s credit limit is $10K in your AR tool but $5K in QuickBooks? Invoice marked “paid” in one system but “pending” in another?

- The Risk: Month-end close delays and audit nightmares.

- Integration Fix: A single source of truth keeps all systems aligned in real time.

3. Financial Blind Spots

- The Problem: Your CFO can’t see AR collections data in the general ledger until someone manually exports a report.

- The Risk: Decisions made with stale data—like overestimating cash flow.

- Integration Fix: Live AR metrics feed directly into financial dashboards.

4. Process Bottlenecks

- The Problem: Revenue recognition requires 4 clicks in AR software + 6 steps in your accounting platform.

- The Risk: Teams waste time on busywork instead of chasing late payments.

- Integration Fix: Automated workflows trigger cross-system actions (e.g., payment posts → revenue booked → GL updated).

5. Patchwork Reporting

- The Problem: Combining AR aging reports with P&L data means copying/pasting spreadsheets.

- The Risk: Leadership gets inconsistent insights (if they get them at all).

- Integration Fix: Unified analytics with pre-built AR-to-GL reconciliation reports.

How Integration Transforms Your AR Workflow

| Before Integration | After Integration |

|---|---|

| Manual data entry → 40% error rate | Zero-touch sync → 99.9% accuracy |

| 7-day lag in financial visibility | Real-time cash position updates |

| 10+ steps to match payments | Automatic payment application |

| Static Excel reports | Live AR KPIs in BI tools (Power BI, Tableau) |

Real-World Impact: Companies using integrated AR automation software:

- Reduce DSO by 12–25 days (PYMNTS)

- Cut invoice processing costs by 65% (Ardent Partners)

- Close books 50% faster (Deloitte)

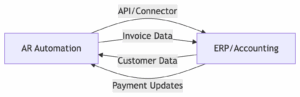

How AR-ERP Integration Works

1. Data Flow Architecture

2. Key Integration Methods

| Method | Speed | Cost | Best For |

|---|---|---|---|

| Native APIs | Real-time | $$$ | Enterprises |

| Pre-built Connectors | Near real-time | $$ | Most UAE SMEs |

| File Transfers | Batch | $ | Legacy systems |

3. Critical Data to Sync

- Customer Master Data (payment terms, credit limits)

- Invoice Creation/Status

- Payment Applications

- Credit Memos & Adjustments

- GL Coding & VAT Details

AR automation without integration is like a phone without service—you’re paying for features you can’t fully use. Modern finance runs on connected systems, not silos.

Top 5 Integration Benefits for UAE Businesses

- 80% reduction in manual data entry errors

- Real-time cash position visibility

- Automated VAT compliance for UAE/FTA

- 60% faster month-end closing

- Unified reporting across finance teams

Tired of Swivel-Chair Accounting?

UPFRONT’s pre-built integrations eliminate manual work between your AR automation and accounting systems.

See Integration Demo →Implementation Roadmap

Phase 1: Preparation (Week 1-2)

- Audit data quality across systems

- Map field-level integration requirements

- Select integration method (API/connector/EDI)

Phase 2: Testing (Week 3-4)

- Validate 100+ test transactions

- Establish exception handling protocols

- Train super-users

Phase 3: Go-Live (Week 5)

- Parallel run for 7 days

- Monitor auto-match rates

- Optimize workflows

Phase 4: Optimization (Ongoing)

- Analyze match exception trends

- Expand to AP automation

- Enable advanced analytics

Integration Challenges & Solutions

| Challenge | GetUpfront Solution |

|---|---|

| Legacy system limitations | CSV bridges with validation rules |

| Data format mismatches | AI-powered field mapping |

| VAT compliance gaps | Built-in FTA/ZATCA rules engine |

| Payment matching errors | Machine learning cash application |

FAQs – Integrating AR Automation

1. What are the key steps for integrating AR automation into existing systems?

The process of integrating AR automation involves analyzing current receivables workflows, choosing AR automation software compatible with ERP and CRM platforms, and setting up data synchronization for invoices, payments, and collections. A successful integration ensures seamless data flow, minimal manual intervention, and full visibility over accounts receivable operations.

2. How does integrating AR automation improve cash flow?

Integrating AR automation enhances cash flow by accelerating invoicing, automating payment reminders, and enabling faster reconciliation. This AR integration cash flow improvement reduces Days Sales Outstanding (DSO), increases on-time payments, and optimizes working capital utilization—helping businesses in the UAE and GCC maintain healthy liquidity.

3. What challenges arise when integrating AR automation solutions?

Common challenges when integrating AR automation include system compatibility issues, data inconsistencies, and user resistance. Companies must ensure their automation platform offers flexible APIs, supports secure data handling, and includes real-time monitoring to overcome these obstacles and achieve successful AR transformation.

4. Why is real-time analytics important when integrating AR automation?

Real-time analytics integrating AR automation gives finance teams instant insights into invoice statuses, customer payment patterns, and cash flow forecasts. This visibility empowers decision-makers to resolve disputes faster, optimize collection strategies, and proactively address potential cash flow risks.

5. How does integrating AR automation improve customer satisfaction?

By integrating AR automation, companies offer clients accurate invoices, automated notifications, and self-service portals. This leads to fewer disputes, faster issue resolution, and a smoother payment experience—ultimately strengthening customer trust and loyalty, and contributing to overall AR integration cash flow improvement.

Key Takeaways

- Pre-built connectors reduce implementation time by 80% vs custom coding

- Real-time sync eliminates 4-6 hours of daily reconciliation

- UAE compliance requires tight AR-ERP integration

- Phased rollout minimizes business disruption

Ready to connect your systems? Our integration specialists can help—contact us today.

→ Future-proof integration: AI in AR Automation→Transform efficiency: AR Automation Industry Impact→ Next-gen processing: Future of AR Automation→Regulatory clarity: Digital vs Compliant Invoicing UAE→ Eliminate bottlenecks: AR Automation Showdown