How Automation Boosts Productivity and Strategic Impact?

In the hustle of the UAE and GCC business world, finance teams are expected to be more than just number crunchers these days. They need to be strategic thinkers, offering insights that fuel growth and improve operational efficiency finance. But what often happens? Talented finance pros get stuck doing manual, repetitive tasks, especially in accounts receivable (AR). This admin quicksand doesn’t just kill finance team productivity; it stops them from focusing on the high-level strategic work that really matters. Enter AR automation. It’s like a superpower, automating the boring bits of invoicing and collections, freeing up precious time. This isn’t just about efficiency; it’s about letting your finance team shift from just processing transactions to analyzing strategy, boosting their impact and making their jobs way more interesting. Let’s explore the AR automation benefits and how they help your team save time on financial tasks and step into more strategic finance roles.

Why Traditional AR Kills Finance Team Productivity

Traditional AR Processes Fail SaaS Businesses

Legacy systems plague GCC finance teams with:

- Manual Processes: Paper invoices, manual data entry, and physical checks breed errors (15%+ discrepancy rates).

- Delayed Payments: Slow processing + postal dependencies strain cash flow.

- Blind Spots: No real-time visibility into invoice status or aging balances.

- Communication Chaos: Email/phone tag escalates disputes and delays.

- Operational Bloat: 20+ hours/week wasted on reconciliation and chasing payments.

- Scalability Walls: Systems buckle at >50 invoices/month.

- Fraud Vulnerabilities: Unaudited manual workflows invite financial leaks.

For UAE businesses, these flaws magnify under FTA compliance pressures.

This endless loop of manual work stops finance pros from doing the value-added finance activities that truly move the needle for the business and make their jobs more rewarding.

AR Automation Benefits:

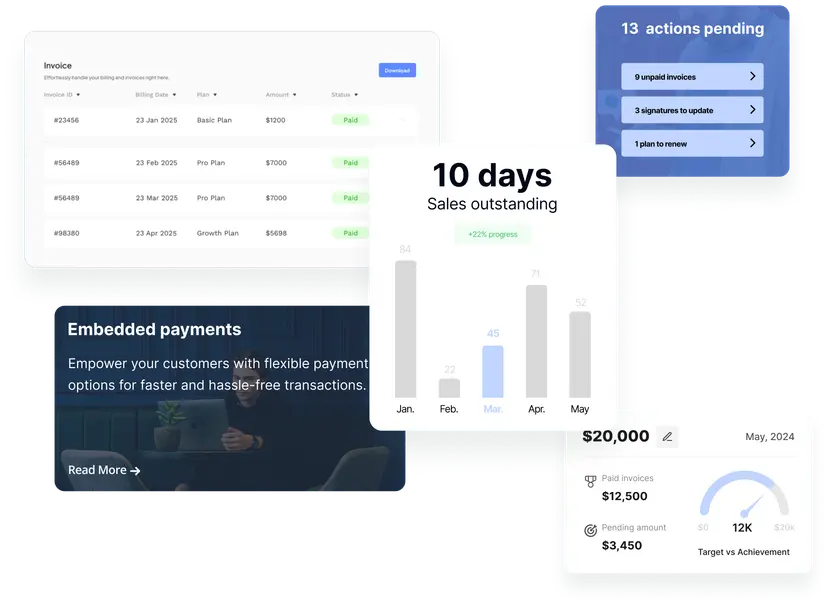

AR automation software, like Upfront, tackles these productivity drains head-on:

- Invoice Magic: Creates and sends invoices automatically – eliminating manual data entry errors and delays.

- Reminder Bot: Sends polite, timely payment reminders without anyone lifting a finger.

- Easy Payments: Makes it simple for customers to pay online, meaning less chasing for your team.

- Auto-Matching: Matches payments to invoices automatically, slashing reconciliation time.

By taking over these routine chores, AR automation frees up a massive chunk of your finance team’s time. This isn’t just about saving hours; it’s about enabling a fundamental shift – a key part of finance transformation.

Stepping into Strategic Finance Roles

So, what can your team do with all this newfound time? They can finally step into those crucial strategic finance roles:

- Planning & Analysis (FP&A): Building budgets, better forecasts (predicting cash flow), analyzing performance, and offering real insights.

- Cash Flow Mastery: Digging into cash flow trends, finding ways to optimize working capital management techniques, and crafting strategies to improve business cash flow.

- Being a Business Partner: Working closely with sales, ops, and other teams, providing the financial angle to help them make better decisions.

- Making Things Better: Looking for more ways to improve processes across the finance department (accounting process improvement).

- Managing Risk & Rules: Focusing on controls, compliance (like UAE VAT invoicing rules), and spotting financial risks early.

- Tech Savvy: Exploring and managing other finance process automation tools.

- Data Detective: Using AR reporting and analytics and other financial data to spot trends, opportunities, and problems.

This shift turns finance from a back-office cost center into a forward-looking strategic partner.

Transform AR Chaos into AI-Driven Cash Flow

UPFRONT automates invoicing, reconciliation, and collections while ensuring GCC compliance. See how our machine learning predicts delays and unlocks trapped capital.

Book Your AI AR Demo →The Impact on Employee Morale Finance Team

The perks go beyond just getting more done; they boost employee morale finance team significantly:

- More Engaging Work: Doing strategic analysis is way more satisfying than manual data entry.

- Learning & Growing: Automation opens doors for finance pros to learn new skills in analysis, tech, and strategy.

- Less Stress: Automating collections and cutting errors reduces the headache of chasing payments and fixing mistakes.

- Feeling Valued: Contributing to strategy makes people feel like they’re making a real difference.

- Better Balance?: More efficiency can mean less pressure and maybe even fewer late nights.

Investing in automation shows you value your finance team’s skills and well-being. From Manual Drudgery to Strategic Impact

| Manual AR Task (Time Drain) | Strategic Activity Enabled by Automation | Why It Matters |

| Manual Invoice Creation/Data Entry | Building Financial Models & Forecasts | Better planning, smarter spending |

| Manual Reminders & Collections | Analyzing Customer Payment Behavior & Credit Risk | Less bad debt, smarter credit decisions |

| Manual Cash Application/Reconciliation | Optimizing Working Capital & Cash Flow Strategies | More cash on hand, lower borrowing costs |

| Fixing Invoice Errors | Partnering with Sales/Ops on Pricing & Profitability | Better margins, smarter business deals |

| Manual Aging Reports | Deep Dives into AR Analytics for Insights | Data-driven choices, spotting where to improve |

| Filing Paperwork | Finding & Implementing More Finance Process Automation | Ongoing accounting process improvement, more efficiency overall |

Tips for Boosting Finance Team Productivity

Getting the most out of automation means managing the change well:

- Share the Why: Explain that automation is about freeing them up for better work, not replacing them.

- Train Them Up: Make sure everyone knows how to use the new AR automation software.

- Rethink Roles: Work together to redefine jobs, focusing on the new strategic tasks.

- Set New Goals: Define what success looks like with this freed-up strategic time.

- Cheer the Wins: Celebrate when the team embraces the new way of working and achieves strategic goals.

Good change management makes the transition smooth and maximizes the productivity boost.

FAQs – How Automation Boosts Productivity: Strategic Impact on Businesses

1. How does automation improve business productivity?

Automation enhances productivity by reducing manual data entry, eliminating errors, and speeding up repetitive tasks. In AR processes, UPFRONT’S automation platform enables UAE companies to process invoices, track payments, and reconcile accounts faster—freeing teams to focus on strategic growth activities.

2. What is the strategic impact of automation on business operations?

The strategic impact of automation includes improved cash flow visibility, faster decision-making through real-time analytics, and better scalability. UPFRONT’S AR automation tools allow UAE firms to optimize their finance operations while preparing for regional expansion and market changes.

3. How can AR automation boost employee productivity in finance departments?

AR automation reduces tedious tasks like manual invoicing, follow-up emails, and reconciliations. With UPFRONT, UAE finance teams gain access to auto-generated reports, real-time payment tracking, and AI-driven forecasting—allowing staff to focus on high-value activities like credit risk management and customer relations.

4. Why is automation important for scaling business productivity in the UAE?

For UAE enterprises aiming to grow regionally, automation supports scalability by handling higher transaction volumes, multi-currency processing, and integrated payment solutions without increasing headcount. UPFRONT’S AR automation platform adapts to business growth while ensuring regulatory compliance.

5. What types of business processes benefit most from automation?

Key processes that benefit from automation include:

- Accounts Receivable (AR) management

- Payment reconciliation

- Cash flow forecasting

- Customer communication (payment reminders)

UPFRONT specializes in AR process automation for UAE businesses, maximizing productivity while ensuring accurate cash flow management.

Ready to transform your finance team from processors to strategic powerhouses? Free them from manual AR tasks and watch finance team productivity soar. See how Upfront automates AR to elevate your finance function. Visit https://getupfront.io/ and unlock your team’s potential!

→ Decision advantage: AR Reporting Analytics → Operational agility: Streamlined Operations Automation → Productivity science: Automation Boosts Productivity → Tech comparison: Future of AR Automation AI Blockchain → Funding options: Invoice Financing vs Discounting UAE